food tax in massachusetts

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. How is meal tax calculated.

Setting Up Tax Rates And Adjusting Tax Options

LicenseSuite is the fastest and easiest way to get your Massachusetts foodbeverage tax.

. Effective in 2023 the. The sales tax is imposed upon admission charges collected by a place of entertainment where food alcoholic beverages or both are sold unless all the following. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

2022 Massachusetts state sales tax. The tax is levied on the sales price of the meal. Please note that the sample list below is for illustration purposes only and may contain licenses that.

Meals are also assessed at 625 but watch out. In MA transactions subject to sales tax are assessed at a rate of 625. A restaurant is any.

And junk food taxes have shown no negative impact. Multiply the cost of an item or service by the sales tax in order to find out the total cost. Monthly funds on an EBT card to buy food.

That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate. And junk food taxes have shown no negative impact. 40 60 or 80 a month put.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. While the Massachusetts sales tax of 625 applies to most transactions there are certain items that may be exempt from taxation. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes.

The tax is 625 of the sales price of the meal. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the. Harvard researchers estimate adding pennies to sugary drinks alone would raise 368 million annually in Massachusetts.

The sale of food products for human consumption is. In the state of Massachusetts any service charge by a caterer is not considered to be taxable so long as the caterer prepares food which was owned by the client at a fixed location. The base state sales tax rate in Massachusetts is 625.

The Massachusetts sales tax is imposed on sales of meals by a restaurant. SNAP is administered by the Department of Transitional Assistance DTA. A local option for cities or towns.

Massachusetts Department of Revenue DAIGO FUJIWARA TOM. The tax is 625 of the sales price of the meal. This page discusses various sales tax exemptions in.

Harvard researchers estimate adding pennies to sugary drinks alone would raise 368 million annually in Massachusetts. Massachusetts has a separate meals tax for prepared food. How is meal tax calculated.

Massachusetts voters approved a 4 tax on annual income above 1 million on top of the states current 5 flat income tax. Sales Tax on Meals Overview. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by.

Exact tax amount may vary for different items. What it means for the wealthy. What are the tax rates for sales and meals tax.

The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. A state excise tax. Multiply the cost of an item or service by the sales tax in order to find out the total cost.

Mass House Advances Bill To Create 2 Transfer Tax On Big Boston Real Estate Deals

Sales Tax On Grocery Items Taxjar

Sales Tax Massachusetts Taxpayers Foundation

Everything You Need To Know About Restaurant Taxes

Massachusetts Gives Shoppers Another Sales Tax Free Weekend Wamc

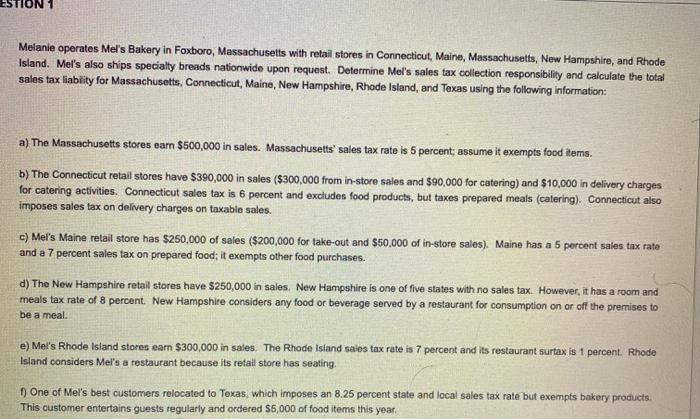

Solved 1 Melanie Operates Mel S Bakery In Foxboro Chegg Com

1986 Massachusetts Tax Law Upends Economic Development Bill

How Are Groceries Candy And Soda Taxed In Your State

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Massachusetts Estate Tax Doesn T Have To Be So Confusing Ladimer Law Office Pc

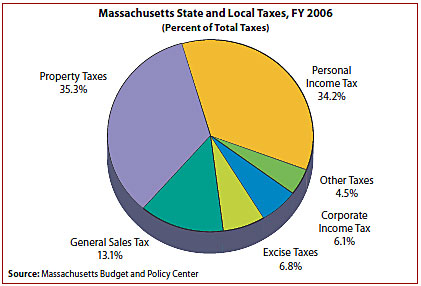

Who Pays Low And Middle Earners In Massachusetts Pay Larger Share Of Their Incomes In Taxes Massbudget

Massachusetts Voters Approve Millionaire Tax Ballot Question

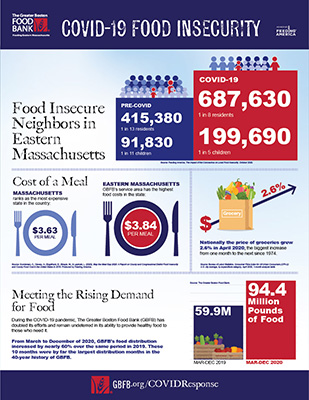

Food Insecurity Across Eastern Massachusetts At An All Time High

The Great Tax Debate Of 2009 Facts And Figures That Help News Events Massachusetts Nurses Association

Ma Voters Decide On Millionaire Tax Driver S Licenses For Those In Country Illegally Fox News

Make The Most Of The Sales Tax Holiday

Naukabout Brewery And Taproom Menu In Mashpee Massachusetts Usa